Previously in this series: Emissions systems, while improved, still causing issues for some owners

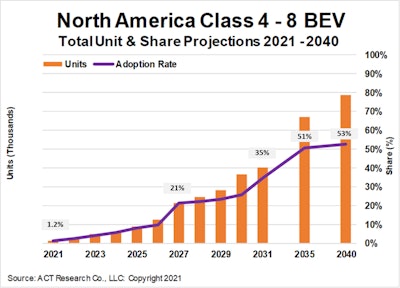

ACT Research on Feb. 7 released its updated battery-electric vehicle and fuel-cell electric vehicle study and adoption forecasts for North American commercial vehicle markets, and projected that in the next five years, the marketshare of battery electric trucks will grow from just 2% today to more than 20% in 2027.

As part of the second edition of its report, "Charging Forward," ACT Research analyzed and built economic-based, total-cost-of-ownership (TCO) algorithms to plot the adoption in 23 work applications of Classes 4-8 battery-electric vehicles across North America.

ACT Research projects a more than 20% adoption rate of Class 4-8 electric trucks in the next five years, with a greater than 50% rate by 2035.

ACT Research projects a more than 20% adoption rate of Class 4-8 electric trucks in the next five years, with a greater than 50% rate by 2035.

“We’ve really spent a considerable amount of time looking at the regulatory landscape to understand how policies and regulations will impact BEV and FCEV [fuel-cell electric] adoption. Everything from ZEV mandates and NOx emissions regulations to relaxing weight penalties and local air quality rules," said Lydia Vieth, ACT’s Research Analyst of electrification and autonomy. "Regulatory impacts are built into our TCO model, and we’ve made it easy for our clients to factor in their own subsidies and incentives."

[Related: Cutting through the heavy-duty e-trucks hype]

While researchers are high on the likelihood of trucking’s adoption of electric trucks, owner-operators in Overdrive's audience, by and large, have yet to perceive a realistic outlook for adoption.